Q2 supply chain outlook shifts focus to resiliency

The supply chain in 2022 was full of uncertainty and a point of frustration for supply chain professionals, businesses, and consumers. Shippers and carriers were impacted by global political unrest, inflationary pressures, port congestion, and an imbalance of equipment. Shipment delays between China and major US and European ports have quadrupled since March 2022, and freight rates have dropped to pre-pandemic levels. The Q2 supply chain outlook may still be uncertain, but will it mimic the events of Q1?

Throughout the last two decades, many supply chains became strictly linear and stretched to their limit in pursuit of efficiency. Mass producing in low-cost countries overseas paired with just-in-time inventory practices created limited inherent resilience in a relatively stable world. However, this low-cost, single-use mentality did not consider massive disruptions that could occur such as the COVID-19 pandemic, shipping delays, environmental governance pressures, and more that forced a shift to segmented supply networks.

Companies are seeking to make their supply chains more cost-efficient, sustainable, and resilient in the face of uncertainty. The entire supply chain is undergoing a reset that involves an entire new business model, from strategy, marketing and design, sourcing, manufacturing, packaging, storage, and transportation. Some are reconstructing their entire value chain in 2023; tomorrow’s supply chains will be less linear, involving a more complex, connected network of partners linked to common approaches.

Supply chain disruption lessened in Q1

Logistics accounts for 71% of the variability within the supply chain, with freight rates and labor being the primary drivers. Since 2008, the trucking industry has experienced a 2% year-over-year (YOY) increase in price, but the past two years those prices increased by more than 45%. Fuel commodity prices and transportation job openings have impacted the rates and compounded stress on logistics operations.

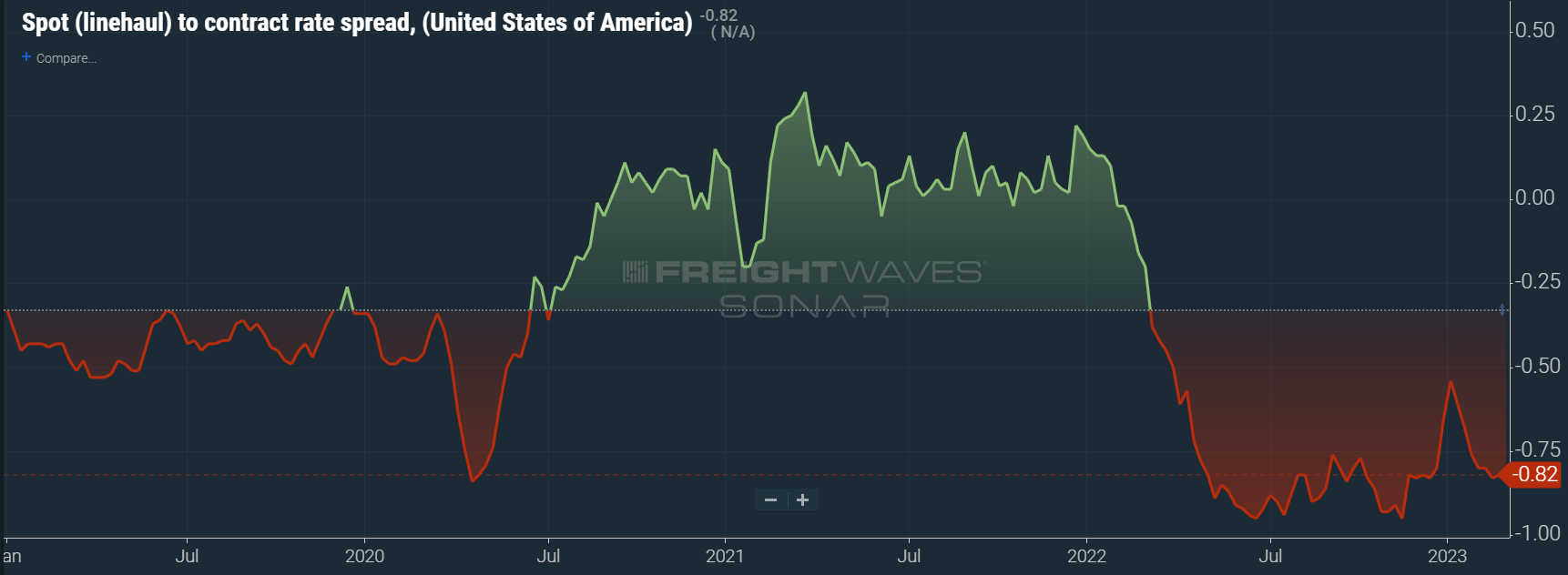

The recent decay of spot rates has had a tangible impact on carriers, resulting in a decrease of weekly revenue. Outside of winter peak season, tender rejection rates have remained the same since late 2022 and indicate that carriers are currently without much pricing power in the spot market. Contract rates have remained stable since late January and have seen a slight gain of 1 cent per mile week-over-week. This could all rebalance once demand rises to meet capacity or if the number of carriers in the marketplace lessens. Shippers have been growing more confident in their pricing power but have also proven themselves to be remarkably cautious through Q1.

Higher costs for diesel, industrial equipment, and major capital expenses (like new and used trucks) remain elevated, however other underlying prices have begun to come down. The inflationary hangover of last year remains largely due to the backlogs of inventory built up during the pandemic’s surge in consumer demand. The largest cost that firms are now facing is labor. Worker shortages are hitting the supply chain industry hard, especially amongst truck drivers and warehouse workers. But even so, there is easing of some supply chain strains and less logistics issues contributing to current inflation.

Second quarter expectations remain consistent

Given the potential for freight demand in Q2, inflationary pressure is expected to ease throughout the year. The industry consensus formed in recent months is that trucking companies would see a positive demand inflection in the back half of 2023. Recruiting and retention of qualified workers will remain the top challenge for supply chain executives. The industry’s annual report card released on industry attitudes at ProMat 2023 found that 57% of respondents said that hiring and retaining qualified workers is one of the biggest supply chain challenges.

The survey also found that 74% of respondents plan to boost their technology investments in 2023, with the highest level of IT adoption in inventory and network optimization. Companies are looking to invest in new technologies to improve efficiency and reduce the need for repetitive manual labor. In years past, it was easy to collaborate with a small set of supply chain partners but with the shocks of the last three years there has been a need to widen collaborative efforts and data-sharing capabilities.

Demand for new trucks is expected to remain steady as large fleets replace their aging equipment and adhere to new emissions standards. Used trucks will soon flood the market and drive down prices on equipment significantly. However, overall market conditions in Q2 will likely remain consistent with Q1 with no big fluctuation from a rate and capacity perspective. Big disruptions could be coming in Q3, so now is the time to double down on service and communication while relying heavily on existing relationships and building new strategic partnerships.

Will the rest of 2023 bring new supply chain issues?

Constant shifts in supply and demand are typical of the logistics industry and there are many predictions for 2023. Bottlenecks that choked the global supply chain in 2022 are slowly disappearing and the almighty consumer is now the biggest factor in freight availability. While consumers remain predictably unpredictable, there are still additional key factors and trends shaping the US and global economy through the year ahead.

The bottom line is that companies must improve their short- and long-term supply chain resilience and flexibility to remain stable regardless of the macroenvironment. Diversification is a meaningful step towards long-term benefits, but it should also be considered with the context of a possible global recession. A 12-month outlook of supply chains is uncertain at best and highly turbulent at worst. Switching strategies from results-oriented to process-oriented will dramatically reduce the vulnerability of a supply chain in an uncertain or unstable environment. As seen in recent years, relying on a single supplier, port, country, or region is most likely to cause further issues.

In October 2022, the Global Supply Chain Pressure Index was close to its lowest level in nearly two years. Last month in February 2023, global supply chain pressures decreased considerably and are now below the historical average, indicating that global supply chain conditions have returned to normal after experiencing temporary setbacks around the turn of the year. While the supply chain may not completely normalize to pre-2019 levels, there will still be steady improvements in 2023.

Sustaining strategic partnerships with industry experts

In 10 years, digital supply chains will be the norm, offering seamless end-to-end networks with transparency at all levels of planning and execution. Here at ITS, we continue to invest in our people while complementing them with top-tier technology services. Our focus is to help and empower our employees with agile technology so that they have the tools to be effective and efficient at their roles. As a customer, you are more than just a number at ITS. We focus on building relationships and learning your supply chain inside and out to provide the highest level of service possible.