Key takeaways:

- The current state of the freight market is in a slow and moderate recovery, marking a new normal that will likely linger well into 2025.

- According to the LMI, the logistics industry gradually expanded throughout 2024.

- An oversaturation of capacity continues to be an issue in the truckload market.

- Load to truck ratios are higher year over year, signaling a marginally better year for truckload than last year.

- Port volumes remain strong.

- Manufacturing is on the uptick.

The logistics and freight industry is experiencing a dynamic period of fluctuations, shaped by a mix of positive growth in some areas and challenges in others. While the logistics industry has shown signs of expansion throughout 2024, a deeper look at rates, demand, capacity, and port conditions reveals a more complex story.

Logistics Managers Index

The Logistics Managers Index takes a broad view of logistics, measuring eight components related to the freight industry—including inventory levels and costs, warehousing capacity, utilization, and prices, as well as transportation capacity, utilization, and prices.

An LMI reading above 50 shows expansion, meaning that inventory levels, warehousing capacity, utilization, etc., are increasing. Vice versa, a reading below 50 shows contraction in the freight industry.

At the end of Q2 and throughout most of Q3, the LMI indicated the logistics industry was in expansion, a consistent theme throughout 2024. LMI scores in Q2 and Q3 of 2024 were:

- 55.3 – June (+9.7 YoY)

- 56.5 – July (+11.1 YoY)

- 56.4 – August (+5.2 YoY)

- 58.6 – September (+6.2 YoY)

This brings the four-month average to 56.7, reflecting growth and a time of recovery for the freight industry.

“Demand is coming back, and we’re seeing supply come to meet it,” said Dr. Zac Rogers, Lead Author of the LMI and Associate Professor of Supply Chain Management at Colorado State University. “But due to the excess capacity we built up over the last few years, supply is not moving as dramatically as before. Supply and demand are slowly moving in tandem, making this the most moderate, but also likely sustainable, freight recovery that we’ve had in the last decade.”

These last four months of recovery are an optimistic contrast to the same period in 2023, where the LMI hit its lowest point of the decade (45.4 in July 2023), marking the freight recession's low.

Rates

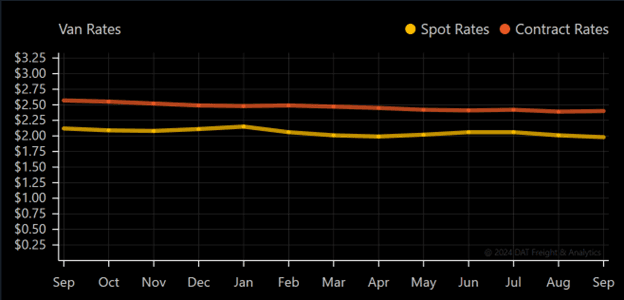

Despite the industry's overall expansion, rates have remained relatively stagnant throughout 2024, per data from DAT. In Q3, dry van spot rates averaged $2.01, while contracted rates averaged $2.40, reflecting an abundance of available capacity to fulfill contracts with less reliance on the spot market.

Trucking Company Starts & Exits

Excess capacity continues to challenge the trucking industry, keeping rates low and squeezing carrier margins. According to DAT data, more carriers exited the market than entered or re-entered throughout Q2 and most of Q3. In August 2024, 10,770 carriers left the market, while 6,642 carriers entered and 2,508 re-entered. The net result: 1,620 carriers left the industry during that time frame. However, in September, more carriers entered or re-entered the market for the first time since July. 4,952 carriers exited the market in September, but 5,308 entered or re-entered, resulting in a net positive gain of 352 carriers.

Exits for September: 4956

New Entrances: 3589

Re-Entrances: 1719

Net: +352

Capacity exits were already slow before September, and now the trend seems to be reversing, which isn’t great news for an oversaturated truckload market.

The question that looms over the industry is this: How many carriers need to exit the market for conditions to reach an inflection point? There isn’t a great answer.

“It’s a shipper’s market with no sign of that changing,” said ITS Logistics CCO Josh Allen. “The caveat here is that the struggle is going to get harder for already struggling carriers. There are lots of carriers out there hanging on by a thread of optimism, but optimism can’t fill a gas tank.”

Capacity

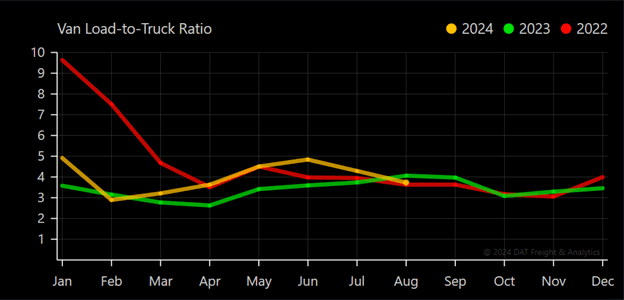

Capacity, tracked through DAT, provides a reliable look at truckload supply and demand. The steep drop in 2022 was a sobering moment for carriers. That level of demand wasn’t normal and hasn’t returned, save for a few bumps. A lingering oversaturation of capacity has become a constant issue, with some mild recovery happening so far in 2024.

Load-to-truck ratios have been higher than previous years for much of 2024. March trended slightly above pre-COVID averages compared to 2018, 2019, and 2020, but still fell below the 10-year average from 2013-2023.

Load-to-truck ratio will likely increase in Q4 as more freight moves to cover peak season. This will become especially prevalent on the West Coast as shippers divert freight to avoid East Coast disruptions. Since any increase in volume will likely be related to retail, the rise will not impact the industry equally and will predominantly benefit carriers working West Coast lanes for retailers.

Import Volume & Port Conditions

According to a September report by Descartes Systems Group, August import volume dropped slightly from July but remained above the 2.4 million TEU mark that has historically stressed U.S. maritime logistics infrastructure. In September, the Port of Long Beach reported record volume of 954,706 TEUs, up 27% YoY. This helped drive an all-time high volume of 2,854,904 million TEUs in the third quarter.

2024 has come with its own share of disruptions—geopolitical tensions in the Middle East and the Suez Canal, election uncertainty and the possibility of heightened tariffs, the Francis Scott Key Bridge Collapse, threats of Canadian rail strikes, a short strike by the ILA, which threatens to begin again on January 15, and most recently, hurricanes in the Southeast.

Many of these disruptions have disproportionately impacted East and Gulf Coast ports as shippers divert freight to the West.

While diversions could eventually lead to congestion in West Coast ports, as of right now, capacity at the ports is keeping up. The more complicated problem has to do with inland rail ramps.

“Keep in mind that diverted freight needs to make its way inland somehow,” said VP of Global Supply Chain Paul Brashier. “Which is why we marked inland rail ramps as elevated in September's three disruptions in Port/Rail Freight Index.”

According to Brashier, shippers can avoid potential congestion on West Coast rail ramps by bypassing inland rail legs altogether—dray off containers and cross-dock into one-way trucking for the inland journey.

With demand for capacity high on the West Coast, there is the possibility that fleets may become unbalanced, hurting capacity on the East Coast and Middle America.

Port conditions are constantly changing. Stay on top of the latest updates with the ITS Logistics Port/Rail Ramp Freight Index.

Distribution & Fulfillment

As of September 2024, the national industrial vacancy rate in the U.S. was approximately 6.7%, reflecting an upward trend from the previous months, per data from Commercial Edge. This trend of increasing vacancy rates suggests a temporary supply-demand imbalance as new developments outpace demand growth in certain regions.

This increasing vacancy rate followed a general downward trend in the warehousing sector that started in April, suggesting that prices are softening for warehousing and storage services. As new supply enters the market, especially in major industrial hubs, pricing pressure could persist, unless demand accelerates, or development slows down.

Manufacturing

According to the United States Manufacturing PMI, manufacturing as an industry has been in a state of contraction since March of 2024, with a slight uptick in September. At the same time Industrial Production, as measured by the Federal Reserve, has averaged 102.8 (2.8 points above baseline) since March of 2024, which reflects positive conditions and increasing production for US manufacturing.

Growth in production could be a good sign for future truckload volumes, especially if the uptick in Manufacturing PMI continues over the coming months. Manufacturing and full-truckload volume are closely linked, as manufacturing makes up 31.67% of full truckload’s value share—the largest share out of any industry, per data from Mordor Intelligence.

Interest Rates

In September, the Federal Reserve lowered interest rates by 50 points. This cut in interest rates does two things: it makes borrowing for big ticket purchases more favorable for consumers, and it also makes borrowing cheaper for struggling companies looking to purchase runway on credit. The former is positive for the logistics industry, as more consumer purchasing could have broad-ranging benefits for supply chain and manufacturing. The latter is not positive, as fewer exits mean continued oversaturation of capacity.

Forecast for 2024 & Early 2025

The current state of the freight market is in a slow and moderate recovery, marking a new normal that will likely linger well into 2025. According to the LMI, the logistics industry gradually expanded throughout 2024. An oversaturation of capacity continues to be an issue in the truckload market. However, load to truck ratios are higher year over year, signaling a marginally better year for truckload than last year. Port volumes remain strong. And manufacturing is on the uptick.

Peak season and consumer holiday spending will likely increase volumes and rates for some, specifically for transportation providers working with retail volumes on the West Coast. However, that lift will not be felt across the transportation industry.

As more freight is diverted to West Coast ports to avoid disruption, the chance of port congestion increases. If conditions stay the same, shippers could experience a spike in ocean carrier rates leading up to the Lunar New Year peak.