Freight demand continues to drop in a softened market

The Logistics Managers’ Index that measures logistics, transportation health, and overall freight demand in the US reached an all-time low in March. The data shows transportation prices hitting bottom, driven by continued sluggishness in freight markets. The drying up of demand among parcel carriers has also extended to ocean carriers as they struggle to fill up the capacity they have built up over the past few years.

Logistics factors that are challenges for carriers pose an opportunity for shippers to take advantage of lower rates and greater availability of freight. The increased capacity will be favorable when demand begins to rebound, but in the meantime, shippers are being selective when choosing their partners in the market. Volumes are predicted to pick up for the traditional late summer peak season.

Maritime consultant Drewry predicts that average global freight rates, a combination of spot and contract rates across all trades, will drop 60% this year. The American Trucking Association’s (ATA) monthly index fell 5.4% in March 2023–the largest monthly drop since the start of the pandemic in April 2020.

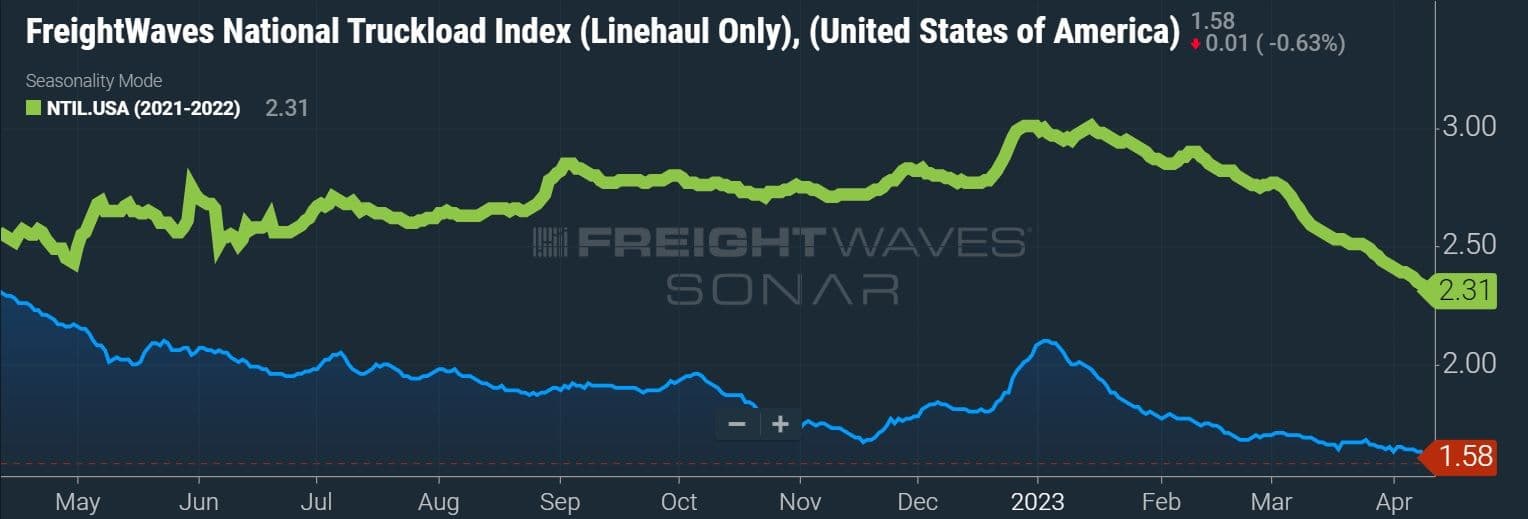

US endures steady decline of freight demand for the past 12 months

On-demand trucking prices have been on a continuous decline since May 2022, when it was noted that a further drop of 10 – 20% would push many owner-operators to exit the industry. Surging diesel fuel costs, equipment and insurance costs, and other operational necessities have put further pressure on the US trucker. More than 20,000 drivers entered the market within the first few months of 2022 alone, lured by high rates and the desperate demand to move the nation’s freight.

Staying in business as an owner-operator can be a costly business. The cost of trucking in 2021 increased to its highest level in the 15-year history of the American Transportation Research Institute’s annual Operational Costs of Trucking research. Increasing by 12.7% from 2020, the marginal costs of trucking have risen to $1.86 per mile with fuel having the single largest increase of 35.4%. However, even excluding fuel, marginal costs rose by 7.5%.

The ATRI report found that smaller carriers generally had higher operating costs based on a number of factors. These small players typically bring less negotiating power to the table when it comes to the cost of things like fuel, repairs, and maintenance. Some larger carriers even have their own repair shops to keep their trucks maintained and they also have the ability to purchase parts on a larger scale. Tires are a perfect example of economies of scale, in which the more units that are purchased the lower the price per mile marginal cost it.

Produce season could offer promising increase in freight volume

Produce season in late spring and early summer can be some of the best times of the year for freight volumes, with some even calling it the “100 days of summer”. Fruitful states like California have loads full of perishable produce that needs to be hauled to grocery stores and distribution centers across the country. This year there is some concern around the historic rainfall on the West Coast and how it will alter the typical harvesting schedule. Some crops will need to be gathered later than expected and some yields will be weak.

The state of California has experienced massive flooding that is preventing workers from harvesting lettuce and strawberries, while also preventing the planting of crops like tomatoes. The Associated Press reported in March that around 20% of the strawberry fields in a key growing region had been submerged for at least a week when a local levee broke. Farmers have also encountered challenges in entering deluged lettuce fields in the Central Valley, with some crops showing signs of disease. The Golden State produces over a third of the nation’s fresh fruits, vegetables, and nuts, but just how depleted the harvest will be remains to be seen.

“Organizations in the industry are focusing on the bottom line and looking to cut costs where they can to increase profitability. At ITS, we are focusing on refining our processes, building up our people, and sustaining strong relationships. Good processes will carry you through the tough times to withstand adverse market conditions. Building sustainable long-term partnerships allows you to stay personally connected with your customer and your vendors. With trust and open communication, we can all successfully navigate the supply chain.” – Manny McElroy, SVP of Transportation

North America freight market conditions

Most supply chain professionals expect a degree of normalization this year as stock levels stabilize. The April issue of Freight Pulse from Morgan Stanley found that 75% of shippers polled expect inventories to normalize, with half predicting this in the second half of 2023. Contract freight tonnage has taken steep declines in the past few months due to falling home construction, decreasing factory output, and soft retail sales.

Truck production is expected to fall off in the second half of 2023, which could potentially increase capacity as the number of trucks available to haul freight tightens. The gap between contract and spot rates has been shrinking and when an inversion occurs, that typically indicates the bottoming of the market. Diesel fuel prices have also been gradually decreasing since November 2022, but still remain higher than pre-COVID pricing.

How the trucking industry can build further resiliency

Focus on operational efficiencies internally and adopt the belief that the market is going to come back. Don’t stray too far from the successes that have gotten you to this point. Instead of being reactionary and changing your entire business model, focus on what has made you successful.