ITS Logistics January 2024 Port Rail Ramp Index

West Coast Set to Experience Increased Transpacific Volumes Due to Seasonal Lunar New Year and Geopolitical Unrest

– ITS Logistics Index forecasts long-term contracted rates and capacity negatively affected due to global supply chain disruptions –

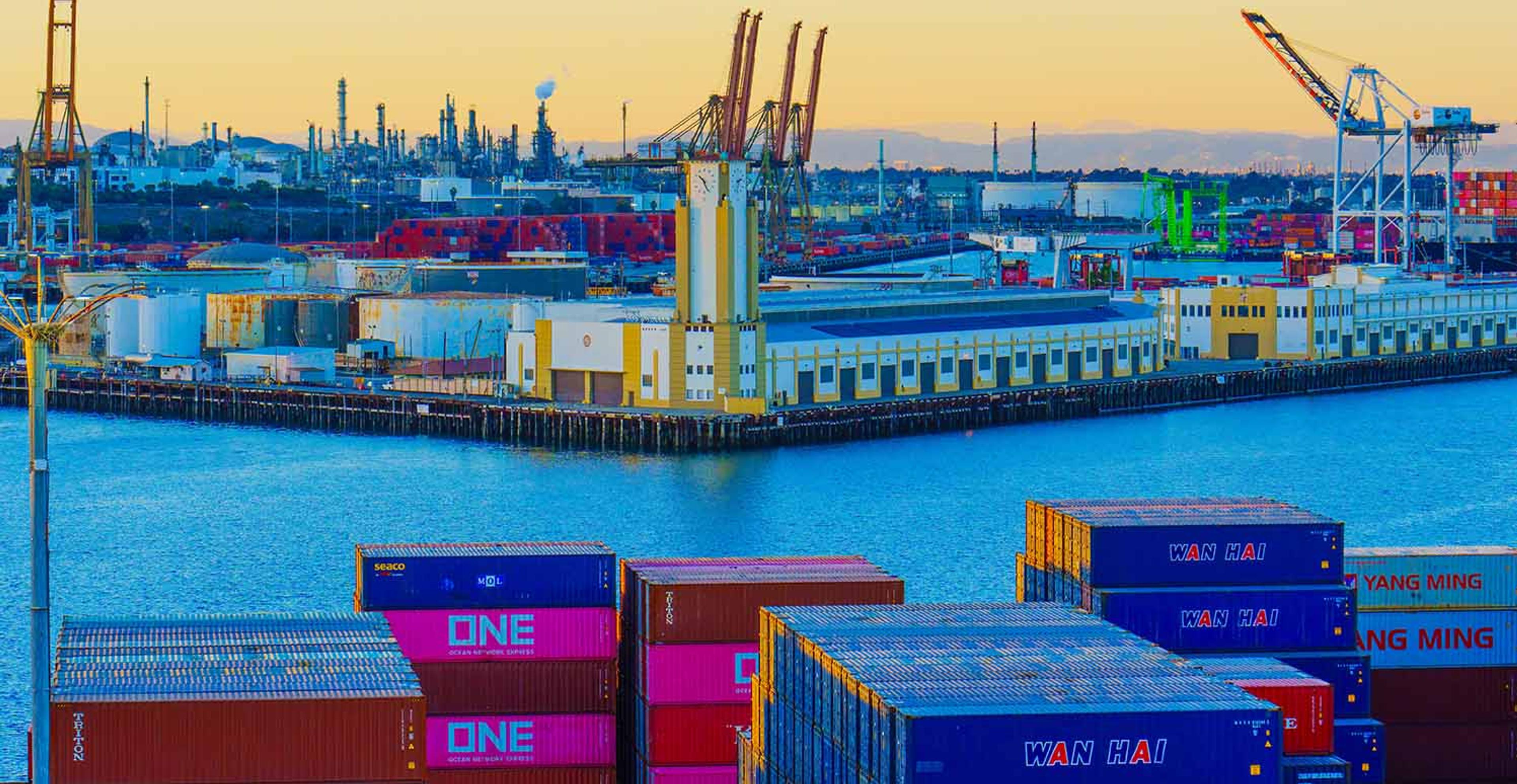

(RENO, NEV.: January 22, 2024) – ITS Logistics today released the January forecast for the ITS Logistics US Port/Rail Ramp Freight Index. This month, the index reveals increased transpacific volumes on the U.S. West Coast due to seasonal Lunar New Year restock as well as the strong possibility of congestion at East Coast ports. The current Lunar New Year restock has been paired with diverted volumes that are a direct result of shippers’ efforts to avoid the crisis in and around the Suez Canal. As a result, underutilized West Coast ports are expected to become stressed, especially in the Los Angeles and Long Beach terminals.

“Despite our data showing all operations at normal levels, we are projecting that status to drastically change at both rail ramps and ports throughout the U.S. towards the end of January and beginning of February,” said Paul Brashier, Vice President of Drayage and Intermodal for ITS Logistics. “On the U.S. East Coast, there is the strong potential that containers could be diverted to unscheduled ports throughout the US Gulf/East Coast to get vessels back into position due to increased transit times.”

As more freight is routed to the U.S. West Coast to avoid the Suez Canal, a significant amount of that volume will be transported via rail to reach East Coast ports. This will cause congestion at rail ramps throughout the US as the infrastructure absorbs the change to the nation’s supply chain. In addition, data shows that both rates and bookings on transpacific lanes have increased drastically over the last two weeks.

Watch Paul Brashier discuss how Red Sea attacks impact global trade.

Long-term contracted rates and capacity will be affected, especially since these challenges are occurring during the ocean carrier contract season.

According to Reuters, as of last week, U.S. and UK militaries have advised all ships to steer clear of the current conflict zone near the Red Sea. This will raise the risk of a new round of global inflation, with the benchmark Shanghai Containerized Freight Index already showing an increase of 16% week-on-week to 2,206 points last Friday. Furthermore, rates on the Shanghai-Europe route rose 8.1% to $3,103 per 20-foot container on Friday, and rates for containers to the U.S. West Coast increased by 43.2% to $3,974 per 40-foot containers week on week.

“Re-routed lanes from Asia to the US East Coast have additional cost and transit time pressure that will continue to push volumes to transpacific trade lanes,” continued Brashier. “Ultimately, the full spectrum of the supply chain is being impacted globally. As with all disruptions, shippers, as well as carriers, need to be proactive about finding solutions to the current challenges and taking into consideration the financial impact of these decisions that the industry is feeling as a collective.”

ITS Logistics offers a full suite of network transportation solutions across North America and omnichannel distribution and fulfillment services to 95% of the U.S. population within two days. These services include drayage and intermodal in 22 coastal ports and 30 rail ramps, a full suite of asset and asset-lite transportation solutions, omnichannel distribution and fulfillment, and outbound small parcel.

The ITS Logistics US Port/Rail Ramp Freight Index forecasts port container and dray operations for the Pacific, Atlantic, and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions. Visit here for a full comprehensive copy of the index with expected forecasts for the US port and rail ramps.