Peak Season 2023 Roundtable with ITS Logistics Leadership

Predictions for peak season 2023

The freight industry has been bracing for a weak peak shipping season this fall. Freight forwarders, ocean container lines, and airfreight companies have predicted a flat peak due to the low amount of air and sea imports when compared to previous years. Big merchants have continued to destock excess inventory during 2022 through 2023, which has held down seasonal growth in shipping volumes and dampened the outlook for peak.

Freight forwarder Kuehne + Nagel reported a loss of 43% in net revenue in Q2 2023 when compared year-over-year (YOY). Operating profit fell by more than half, led by a sharp decrease in ocean and air freight demand. The company reported it cut its unit costs by 14% from the first quarter of 2023 to the second.

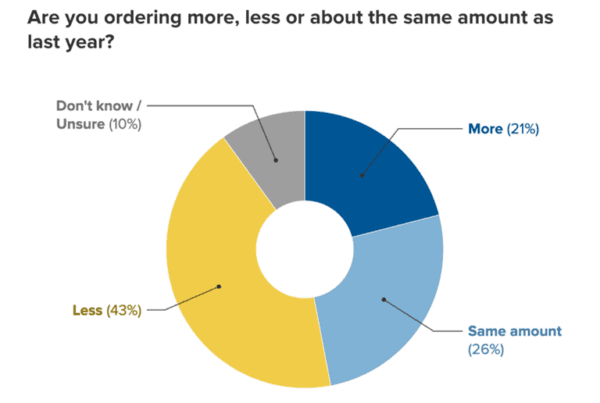

Inflation is down from over 9% in the summer of 2022 to 4% in the CPI reading for May 2023. A CNBC Supply Chain Survey in June found that 43% of retailers are ordering less and expecting the consumer to be on the lookout for discounts. Big-box leaders reported in Q1 earnings reports that consumers are spending less and unseasonable items in warehouses have caused problems of varying degrees.

Trade activity at the Port of Long Beach fell by more than a quarter in July 2023. The port’s performance over the first seven months of the year fell by 25.6% percent when compared with YOY. These figures bring cargo activity closer to levels seen in 2019 when the port handled a similar volume of cargo. Port of LB CEO, Mario Cordero, expects a modest peak shipping season ahead.

A Q&A with ITS Leadership

The latest figures from the National Retail Federation (NRF) predict that US container imports are expected to reach the highest level in nearly a year in August 2023 at over 2 million TEUs. The NRF’s prediction for total imports in 2023 is expected to be down 12.8% from 2022. Peak season last year was muted, and customers had their choice of a wide range of logistics partners. Trusted providers have since put the focus on building relationships and building flexible, resilient supply chains for their customer base.

What challenges will this year’s peak season present? ITS Logistics leaders with expertise in distribution and fulfillment, transportation, and drayage/intermodal weigh in with their thoughts.

With a weak import season, what can be expected for OTR peak season 2023?

“Peak season this year is going to be muted for import drayage due to historically high inventory levels at all Shippers in almost every segment in the US economy. Consumer spending on discretionary goods is the largest contributing factor to the size of the ‘peak season’ we will experience for domestic truckload demand and inventory levels. With the health of the consumer continuing to be very resilient we do expect there to be a more robust domestic truckload peak season than the traditional import peak season. The only caveat being if the US Consumer continues to spend heavily outside of historic patterns on services and experiences as has been the case the last 12 months. Typically, a peak import season this weak would have been a leading indicator of how healthy the OTR peak season would be. This outlier import peak season should not be a solid indicator for domestic truckload’s peak season.

There are some events that could help lift import demand for the remainder of the year. We still expect to see the typical holiday time sensitive containers prioritized by our customers to enter their supply chain quickly to meet consumer demand of particular SKUs. There are also volumes that are being routed to the East and Gulf Coast that will become distressed due to the congestion at the Panama Canal stricken by low water levels due to drought. There is also a very high probability that a heightened hurricane season will adversely affect Gulf and Eastern Seaboard port operations as well as take Gulf coast drilling and refining capacity offline. Both will lift demand and rates. Inventory levels should return to normal by the end of 2023 setting up a typical import cycle in 2024. ”

Adam Angle, Senior Vice President

Will peak season 2023 be muted across the board for every industry?

“Many freight companies are predicting no peak season from a macro-economic perspective. Our team likes to view things from a micro-economic perspective and focus on specific customers, brands, and industries that we work with. The level of peak that we expect to see will largely differ by industry. Look at the cosmetics industry for example. These are tiny little products and a peak season for this freight is not necessarily going to largely impact macro freight volumes. Back-to-school items have been at expected order levels. I personally believe that peak management has gone back to pre-pandemic strategies. Brands are waiting until the very last minute to order products and put them on shelves. Because of increased capacity, rates are favorable now for shippers and there isn’t a need to prebook and hedge capacity against demand. I’ve noticed brands are waiting for last-minute demand signals to build up their product offerings for peak season. Our clients have expressed interest in warehouse capacity restraints and labor markets for this upcoming peak season. This tells us that they expect to have some increase in orders if they’re concerned about space and workforce.”

Kasia Wenker, Director of Supply Chain Solutions

Will this year’s peak season mimic that of 2022 or be more like 2019?

“I think that this peak season will be below 2019 levels and there will be a two-week blip of increased trucking volume instead of the traditional four weeks. Ecommerce customers with pre-planned peak volumes have been forecasting lower levels than usual and already assigned carriers. Our team has visibility into import container volume and those levels have remained lower than typical peak seasons. The only way we could conditions changing is if consumer spending increases drastically. There are still companies looking to destock their warehouse so that doesn’t necessarily mean there will be more new orders to fulfill peak demand. A lot could happen with the economy over the next few months that could push the pendulum the other way. Interest rates could drop, or they could rise. If more people start buying houses, that could trigger increased consumer spending. Everyone is treading lightly and many of our customers want to know how they should plan.”

Manny McElroy, Senior Vice President of Transportation

What trends have you noticed around forecasting and consumer spending?

“We have noticed a lot of hesitancy around peak season forecasting because no one knows what peak season is going to be. My guess is that it will return to more of a normalcy and people are going back to more promotional-based buying. For example, Prime Day was huge this year. The past couple of years people had more disposable cash on hand and they were purchasing all throughout the year. Now what we are seeing is the travel industry growing and spending on consumer goods, both stable and discretionary, has decreased. I think peak season this year will be like pre-pandemic peak seasons, focused on promo days like Black Friday, Cyber Monday, or other big deals that companies have. There is still distressed inventory in the US supply chain and a lot of companies looking to clear that off their books while still retaining some value. We have seen a decent amount of disposal, discounting to retailers, and donations.”

Ryan Martin, President of Assets

Flex operations for high demand with a trusted partner

With nearly 4 million square feet of distribution space, a footprint in 50 markets in North America, and a knowledgeable team of logistics experts, the team at ITS can offer unique nationwide solutions. Combine any 3PL logistics services like dedicated transportation, intermodal and drayage, distribution and fulfillment, and more to create an integrated and dependable supply chain.