Looking for a California Distribution Center? You Should Consider Reno, NV Instead

You may think that a California warehouse is the ideal warehousing and distribution hub for the Western United States, but before making a final decision, you need to consider Nevada as a potentially superior option for your business. A distribution center in Nevada offers many of the same benefits as a California distribution center when it comes to location, but business owners in Nevada experience significant savings when it comes to taxes, labor and the overall cost of doing business. Read on to learn why Reno, NV is the perfect location for your distribution and fulfillment center.

Nevada offers excellent financial advantages for businesses over California

Nevada boasts a favorable tax climate with no corporate income tax, no inventory tax, no franchise tax, no personal income tax, no inheritance tax, no estate tax, no unitary tax and no intangibles tax. The Nevada Governor’s Office of Economic Development also offers additional tax incentives to companies that relocate or expand their businesses, provided they meet the criteria for job creation, average wage, capital investment and medical benefits. Additionally, the state offers incentives for workforce training through the Silver State Works Program. This program offers funding for employer-based training, employer incentive job program and incentive-based employment.

Nevada boasts a favorable tax climate with no corporate income tax, no inventory tax, no franchise tax, no personal income tax, no inheritance tax, no estate tax, no unitary tax and no intangibles tax.

Nevada provides significant tax advantages to companies locating their manufacturing and/or distribution facilities in the state over California (and any other state with a corporate and individual income tax).

The tax advantages achieved by locating in Nevada vs. California arise from California Public Law 86- 272. Under this law, the state of California cannot impose a state income tax on an entity which “solicits orders, or his representative, in such State for sales of tangible personal property, which orders are sent outside the State for approval or rejections, and if approved, are filled by shipment or delivery from a point outside the State.”

In simple terms, if a company merely solicits sales in California and does not have payroll (other than a sales force), real estate, equipment or inventory in California, that company is not subject to California income tax. However, if the company manufactures or distributes inventory from within the state of California, the company is subject to state income tax.

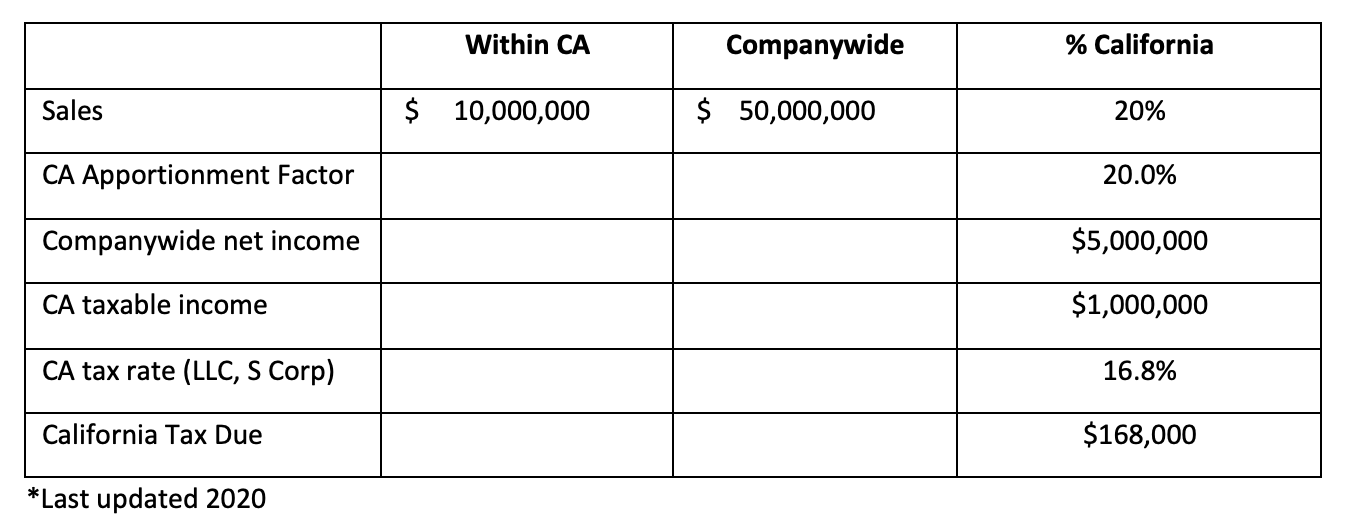

The corporate income tax rate in California is currently 8.84% and the individual income tax rate in California is currently 16.8%*. The rate used in any analysis is determined by whether the company is a C-Corporation or a pass-through entity such as an S-Corporation, LLC or Partnership. C-Corporations will be subject to the corporate tax rate of 8.84%, S-Corporations are subject to a tax rate of 16.8%. California taxes entities utilizing an apportionment factor.

For example:

In this example, the company generated a tax liability of $168,000, which can be eliminated by locating inventory in Nevada. Additionally, sales to other states with corporate and individual income taxes, which are serviced out of a Nevada distribution facility, would minimize that companywide state income tax exposure. This is a significant benefit for a company locating its west coast distribution facility in Nevada.

If you would like an interactive calculator to see how much you could save by moving your distribution center to Nevada, email us today at kwenker@its4logistics.com.

This analysis is very cursory and any company planning to establish a west coast facility may wish to perform a complete sales tax analysis. This analysis would take into consideration actual sales, inventory, and payroll, rent and equipment figures by state and in total. This analysis would also consider the various states a company operates in and the related income tax rates. Numerous companies such as Walmart, PetSmart, Amazon, Starbucks, Tesla and more have moved operations to northern Nevada to benefit from the state tax laws and central distribution location.

In this example, the company generated a tax liability of $168,000, which can be eliminated by locating inventory in Nevada.

Doing business in Reno is also less expensive than in California. Nevada offers competitive commercial utility rates that are less than half of California’s—meaning a Reno warehouse or distribution center is significantly less expensive to run than a California warehouse. Additionally, office and warehouse space lease rates in California range from $.55-$.85 per square foot while in Reno, they range from $.38-$.48. When you couple those savings with the tax savings, you can see that Nevada is truly a great place to do business.

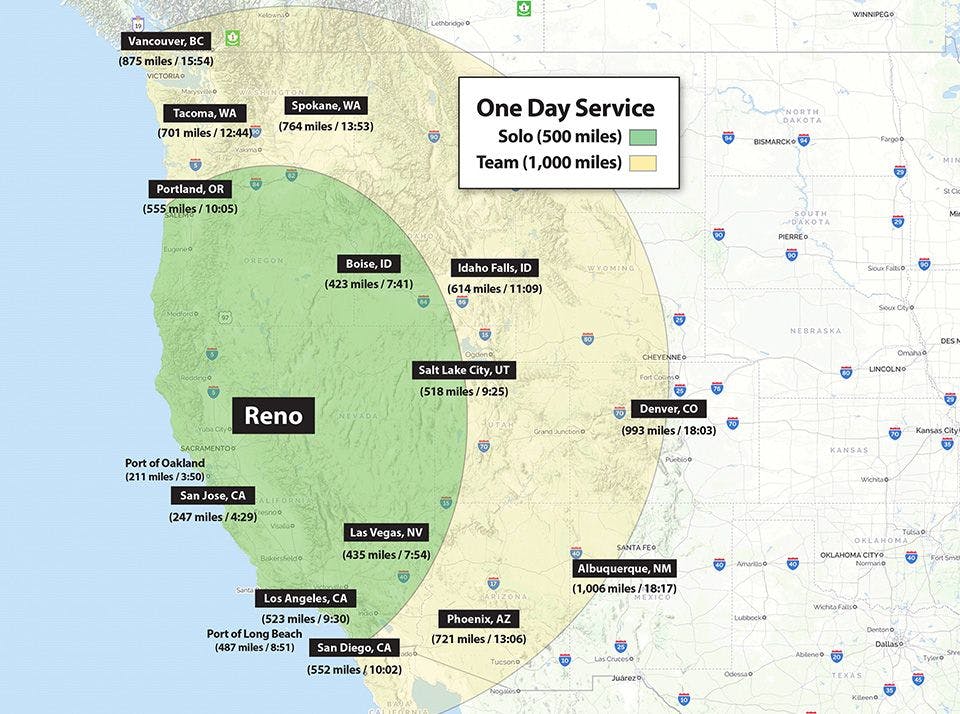

Northern Nevada is the ideal distribution hub for the Western United States

Having strategically placed distribution and order fulfillment facilities is extremely important to ensure your products can reach your customers as quickly and cost-effectively as possible. Many people think that distribution centers in California make a great West Coast hub, but Northern Nevada is actually the better location—and not just for the reasons we discussed above. Due to its location at the center of an extensive transportation network on Interstate 80 and US Highway 580, Reno is within one-day truck service to more than 60 million customers and two-day truck service to 11 western states. It is the perfect spot for your Western United States node, and when paired with an Eastern US location, your Reno warehouse allows you to reach all of the US within two days! Northern Nevada is ideal for companies who are looking to reduce costs while providing a high level of service and meeting customer expectations in their Western markets.

Distribution Services for the West Coast and Beyond

We’ve mentioned this before, but living in Nevada certainly does have its perks. Yes, we’re “The Hub of the West,” but we’re also not alone in our fondness for tax-friendly northern Nevada, either.

Reno is within one-day truck service to more than 60 million customers and two-day truck service to 11 western states.

We offer one-day service on containers from the Ports of Oakland, Los Angeles and Long Beach. Major companies such as Amazon, Zulilly, Tesla, Starbucks, Urban Outfitters, Walmart, Sherwin Williams and many more have distribution service hubs in the Reno/Sparks area.

Workforce in Nevada vs. California

Your employees are an extremely important part of your business success. The greater Reno area has an existing workforce of more than 267,000 individuals, with the quality of life to attract young professionals from the surrounding areas like Sacramento and the California Bay Area. There is also a readily available workforce with skills ranging from business and software development to manufacturing and logistics. At a California distribution center, business owners have to deal with a higher average hourly wage and a higher average cost of workman’s compensation, while Nevada wages tend to be about 33% lower due to a generally less expensive cost of living in Reno and the surrounding areas.

Start your West Coast 3PL strategy today with ITS Logistics

With over 1 million square feet of fulfillment and distribution space in Northern Nevada, ITS Logistics is the perfect partner for all your West Coast 3PL needs. Our team members have years of experience in a wide range of omnichannel and ecommerce fulfillment services, as well as any other specific distribution or warehousing needs you may have. Give us a call today to discuss how a Reno warehouse could be the perfect addition to your supply chain today.